New York City: Transphobes not welcome! Nov. 14

Baltimore Solidarity Event for National Day of Mourning

THURSDAY, NOVEMBER 24, 2022 AT 12 PM – 1 PM

Baltimore Solidarity Event Day of Mourning

McKeldin Square

We welcome all our relations crossed by the US border & ICE.

info@uaine.org * UAINE website * UAINE Facebook Group

Facebook event Donate Masks required! No social, but light box lunches may be available. #MasksUpMayflowersDown #NDOM2022 #NoThanksNoGiving

El malestar de Japón en la nueva guerra fría

A principios de octubre, las Fuerzas de Autodefensa de Japón y la Armada estadounidense se unieron para el Resolute Dragon. Durante la apertura del ejercicio en 2021, Jay Bargeron, general de la 3ª División de Marines de EE.UU. declaró que Estados Unidos está “preparado para luchar y ganar si se le convoca”. Resolute Dragon 2022 siguió a la reanudación en septiembre de los ejercicios militares trilaterales de Japón, Corea del Sur y EE.UU. frente a la península coreana, que se habían suspendido cuando el anterior Gobierno surcoreano intentó acercarse a Corea del Norte. En noviembre, las fuerzas armadas estadounidenses y japonesas se unirán a las de Australia, Canadá y el Reino Unido para realizar el ejercicio Keen Sword, frente a aguas japonesas.

EE.UU. mantiene esta postura a pesar de las reiteradas aclaraciones chinas – incluyendo la del vocero del Ministerio de Asuntos Exteriores, Zhao Lijian, este noviembre – de que “nunca buscará la hegemonía ni se dedicará al expansionismo”.

Resolute Dragon 2022 se realizó en un contexto de tensión entre EE.UU. y China, con la Estrategia de Seguridad Nacional estadounidense identificando a China como su “única competencia”. Siguiendo su propia lógica histórica, EE.UU. considera que China necesita ser limitada por sus aliados regionales y sitúa a Japón en el centro de su nueva Guerra Fría contra China.

Artículo 9

La Constitución japonesa (1947) prohíbe construir una fuerza militar agresiva. Dos años después de que se incluyera en la Constitución el artículo 9 (a instancias de la ocupación estadounidense) la Revolución China triunfó y EE.UU. comenzó a reevaluar el desarme de Japón. Los debates sobre la revocación del artículo comenzaron al inicio de la Guerra de Corea (1950), cuando el Gobierno estadounidense presionó al primer ministro japonés, Shigeru Yoshida, para reforzar el ejército y militarizar la Reserva de la Policía Nacional; de hecho, la Enmienda Ashida al artículo 9 debilitó el compromiso japonés con la desmilitarización y abrió la puerta al rearme a gran escala.

La opinión pública japonesa está en contra de la eliminación del artículo 9. No obstante, Japón ha incrementando su capacidad militar. En el presupuesto 2021, añadió 7.000 millones de dólares (7,3%) al presupuesto militar (de 54.100 millones de dólares), “el mayor incremento anual desde 1972”, según el Instituto Internacional de Investigación para la Paz de Estocolmo. En septiembre 2022, el Ministro de Defensa, Yasukazu Hamada, dijo que Japón “reforzaría radicalmente las capacidades de defensa que necesitamos. … Para protegernos, es importante que tengamos no sólo material como aviones y barcos, sino también suficiente munición para ellos”. Japón aumentará su presupuesto militar en un 11% anual hasta 2024.

En diciembre, Japón dará a conocer una nueva Estrategia de Seguridad Nacional, la primera desde 2014. El primer ministro Fumio Kishida declaró al Financial Times: “Estaremos totalmente preparados para responder a cualquier escenario posible en el este de Asia para proteger las vidas y el sustento de nuestro pueblo”. Parece que Japón se precipita hacia más roces con China, su mayor socio comercial.

Este artículo fue producido para Globetrotter. Vijay Prashad es un historiador, editor y periodista indio. Es miembro de la redacción y corresponsal en jefe de Globetrotter. Es editor en jefe de LeftWord Books y director del Instituto Tricontinental de Investigación Social. También es miembro senior no-residente del Instituto Chongyang de Estudios Financieros de la Universidad Renmin de China. Ha escrito más de 20 libros, entre ellos The Darker Nations y The Poorer Nations. Sus últimos libros son Struggle Makes Us Human: Learning from Movements for Socialism y The Withdrawal: Iraq, Libya, Afghanistan, and the Fragility of U.S. Power (con Noam Chomsky).

La situación de Guinea pone al descubierto la codicia de las empresas mineras extranjeras en el Sahel

El 20 de octubre de 2022, en Guinea, el Frente Nacional de Defensa de la Constitución (FNDC) llamó a protestar en las calles. Los manifestantes exigían al Gobierno militar (el Comité Nacional de Reconciliación y Desarrollo, o CNRD) libertad para los presos políticos y un marco para regresar a un Gobierno civil. Se enfrentaron violentamente a las fuerzas de seguridad y en Conakry, la capital, al menos cinco personas resultaron heridas y tres murieron por heridas de bala. Los principales actos de violencia se produjeron en Ratoma, una de las comunas más pobres.

En septiembre de 2021, el CNRD, dirigido por el coronel Mamady Doumbouya, derrocó al Gobierno de Alpha Condé, con más de una década en el poder e impregnado de corrupción. En 2020, el Colectivo para la Transición en Guinea (CTG) denunció por soborno – ante la Fiscalía Nacional Financiera – al hijo de Alpha Condé (Alpha Mohamed Condé) y al ministro de Defensa (Mohamed Diané). Los acusaban de recibir sobornos de un consorcio internacional a cambio de derechos de explotación de bauxita cerca de Boké.

Boké, al noroeste de Guinea, es el epicentro de la extracción de bauxita (esencial para el aluminio). Guinea posee las mayores reservas del mundo de este mineral (estimadas en 7.400 millones de toneladas métricas) y es el segundo productor a nivel mundial (después de Australia). Toda la minería de Guinea está controlada por empresas multinacionales, como Alcoa (estadounidense), China Hongqiao y Rio Tinto Alcan (anglo-australiana), asociadas a entidades estatales guineanas.

Cuando el CNRD tomó el poder, uno de los temas principales era el control de los ingresos de la bauxita. En abril de 2022, Doumbouya reunió a las principales empresas mineras y dijo que antes de finales de mayo tenían que presentar una hoja de ruta para la creación de refinerías de bauxita en Guinea o abandonar el país. Doumbouya declaró: “A pesar del auge de la minería en el sector de la bauxita, está claro que los ingresos previstos están por debajo de las expectativas. No podemos seguir con este juego de tontos que perpetúa una gran desigualdad” entre Guinea y las empresas internacionales. El plazo se ha ampliado hasta junio, y las exigencias del ultimátum para cooperar o marcharse continúan.

Al igual que los Gobiernos militares de Burkina Faso y Mali, el CNRD en Guinea, llegó al poder en un contexto popular de hartazgo de las oligarquías locales y del dominio francés. Los comentarios de Doumbouya en 2017 en París reflejan este sentimiento. Dijo que los militares franceses en Guinea “subestiman las capacidades humanas e intelectuales de los africanos… Tienen actitudes altaneras y se toman por el colono que todo lo sabe, que todo lo domina”. Este Gobierno golpista – conformado por una fuerza antiterrorista de élite creada por Alpha Condé – ha captado las frustraciones de la población, pero es incapaz de construir un programa viable para salir de la dependencia de las empresas mineras extranjeras. Mientras tanto, es poco probable que las protestas por el retorno a la democracia sean sofocadas.

Este artículo fue producido para Globetrotter. Vijay Prashad es un historiador, editor y periodista indio. Es miembro de la redacción y corresponsal en jefe de Globetrotter. Es editor en jefe de LeftWord Books y director del Instituto Tricontinental de Investigación Social. También es miembro senior no-residente del Instituto Chongyang de Estudios Financieros de la Universidad Renmin de China. Ha escrito más de 20 libros, entre ellos The Darker Nations y The Poorer Nations. Sus últimos libros son Struggle Makes Us Human: Learning from Movements for Socialism y The Withdrawal: Iraq, Libya, Afghanistan, and the Fragility of U.S. Power (con Noam Chomsky).

¿Es la prohibición de los chips de EE. UU. a China una declaración de guerra en la era de la computadora?

Los Estados Unidos han hecho una gran apuesta con sus últimas sanciones globales a empresas chinas de la industria de los semiconductores, creyendo que puede dispararle en la rodilla a China y retener la dominación global. Desde los eslóganes de la globalización y el “libre mercado” de los neoliberales 90, Washington ha regresado a “la vieja confiable” de los regímenes de denegación tecnológica que, junto a sus aliados, siguieron durante la Guerra Fría. Mientras que en el corto plazo pudiese ser efectivo para disminuir la velocidad de los avances chinos, en el largo plazo, para la industria del semiconductor estadounidense, el costo de perder a China (su mercado más grande) tendrá consecuencias importantes. En el proceso, las industrias del semiconductor de Taiwán y Corea del Sur, más los fabricantes de equipos en Japón y la Unión Europea, tienen más probabilidades de convertirse en daño colateral. Algo que nos recuerda de nuevo lo que una vez dijo el ex secretario de Estado Henry Kissinger: “Ser enemigo de los Estados Unidos puede ser peligroso, pero ser su amigo es fatal”.

El propósito de las sanciones estadounidenses (de segunda generación luego de las primeras en agosto de 2021) es restringir la capacidad de China para importar chips de computación, desarrollar y mantener supercomputadores, y fabricar semiconductores avanzados. Aunque las sanciones se esconden bajo términos militares – negarle a China el acceso a tecnologías y productos que pudieran ayudar al ejército chino – en realidad, apuntan contra todos los principales actores del semiconductor en China y, por lo tanto, también su sector civil. La ficción de “excluir el uso militar” solamente le ofrece una débil cobertura de acceso a todos, bajo las excepciones Organización Mundial de Comercio (OMC) en tener que proporcionar acceso al mercado a todos los miembros de la OMC. La mayoría de las aplicaciones militares emplean chips de viejas generaciones y no las últimas versiones.

Las sanciones específicas que los Estados Unidos impusieron incluyen:

-

Chips logic avanzados, requeridos en inteligencia artificial y computación de alto rendimiento

-

Equipos de 16nm logic y otros chips avanzados como FinFET y Gate-All-Around

-

La última generación de chips de memoria: NAND con 128 capas o más y DRAM con 18nm half-pitch

En las reglas, las prohibiciones de equipos específicos van aún más allá, incluyendo muchas tecnologías de vieja data. Por ejemplo, un comentarista señaló que la prohibición de herramientas es tan amplia que incluye tecnología usada por IBM a finales de los años 90.

Las sanciones también abarcan cualquier compañía que emplee tecnología o productos estadounidenses en esa cadena de suministro. Esta es una cláusula en sus leyes: cualquier empresa que “toque” a los Estados Unidos mientras se fabrican sus productos será llevada automáticamente al régimen de sanciones estadounidense. Es una extensión unilateral de la jurisdicción legal del país y puede ser empleada para castigar y destruir a cualquier entidad – una empresa o cualquier otra institución – que esté vinculada directa o indirectamente a los Estados Unidos. Estas sanciones están diseñadas para desconectar por completo la cadena de suministros de los Estados Unidos y sus aliados – países de la Unión Europea y del este asiático– con China.

Además de las últimas sanciones contra compañías que ya se encuentran en la lista de empresas chinas sancionadas, unas 31 compañías adicionales han sido añadidas a su “lista sin verificar”. Estas empresas deben suministrar toda la información a las autoridades estadounidenses en dos meses, o de lo contrario también serán excluidas. Aún más, ningún ciudadano estadounidense o nadie domiciliado en los Estados Unidos podrá trabajar para compañías sancionadas o en la lista sin verificar, ni siquiera para mantener o reparar equipos entregados con anterioridad.

Actualmente el tamaño de la industria global de los semiconductores es de más de 500 mil millones de dólares y es probable que para 2030 se duplique hasta un billón. Según un informe de la Asociación de la Industria de los Semiconductores y el Boston Consulting Group de 2020 (“Cambiando la marea para la fabricación de semiconductores en Estados Unidos”) se espera que China llegue a dar cuenta del 40% del crecimiento de la industria en 2030, desplazando a los Estados Unidos como el líder global. Este es el desencadenante inmediato para las sanciones y su intento de frenar a la industria china quitándole el liderazgo a los Estados Unidos y sus aliados.

Mientras que las medidas mencionadas más arriba tienen la intención de aislar a China y limitar su crecimiento, hay una desventaja para los Estados Unidos y sus aliados al sancionar al país asiático.

El problema para los Estados Unidos – aún más para Taiwán y Corea del Sur – es que China es su mayor socio comercial. Imponer este tipo de sanciones a equipos y chips también significa destruir una buena parte de su propio mercado sin perspectivas de un reemplazo inmediato. Esto es cierto no solo para los vecinos de China en el este asiático sino también para fabricantes como la compañía holandesa ASML, el único proveedor del mundo de máquinas de litografía de ultravioleta extrema (EUV) que produce los chips más recientes. Para Taiwán y Corea del Sur, China no solo es el destino de exportación más grande para su industria de semiconductores, como también de otras industrias, sino que además es uno de sus mayores abastecedores de una gama de productos. Es probable que la separación forzada de China de la cadena de suministros venga también acompañada de la ruptura con otros sectores.

También es probable que las empresas estadounidenses reciban un golpe a sus balances, incluyendo fabricantes de equipos como Lam Research Corporation, Applied Materials y KLA Corporation; las herramientas de diseño automático electrónico (EDA, por sus siglas en inglés) como Synopsys y Cadence; y proveedores de chips avanzados como Qualcomm, Nvidia y AMD. China es el mayor destino para todas estas compañías. El problema para los Estados Unidos es que China no sólo es la parte del mundo con mayor crecimiento de su industria de semiconductores, sino que también es su mercado más grande. Así que las últimas sanciones no sólo perjudican a las empresas chinas en la lista, sino también a las firmas de semiconductores estadounidenses, secando una parte importante de sus ganancias y, por lo tanto, su futuro en inversiones para investigación y desarrollo en tecnología. Mientras algunos de los recursos para inversiones provendrán del Gobierno estadounidense – por ejemplo, el subsidio de 52,7 mil millones de dólares para la fabricación de chips – no se comparan con las pérdidas en su industria que sufrirá como resultado de las sanciones a China. Por todo esto, la industria de semiconductores ha sugerido sanciones más limitadas en su objetivo a la industrias de defensa y seguridad chinas, no las sanciones abarcantes que ahora introdujo Washington: el escarpelo en vez del martillo.

El proceso de separar el régimen de sanciones y la cadena de suministros global no es un concepto nuevo. Los Estados Unidos y sus aliados tuvieron una política similar con la Unión Soviética durante y después de la Guerra Fría, vía el Comité Coordinador para el Control Multilateral de las Exportaciones (COCOM, por sus siglas en inglés) (reemplazado en 1996 por el Acuerdo de Wassenaar), el Grupo de Abastecedores Nucleares, el Régimen Tecnológico de Control de Misiles y otros grupos de la misma naturaleza. En esencia, fueron regímenes de denegación tecnológica que se aplicaron a cualquier país que los Estados Unidos considerase “enemigo”, con sus aliados siguiendo – entonces y ahora – lo que dictase Washington. Los objetivos en la lista de prohibición de exportación no sólo fueron los productos específicos sino también las herramientas que pudieran ser empleadas para fabricarlos. No únicamente en los países del bloque socialista sino también en otros que también, como India, fueron excluidos de acceder a tecnología avanzada, incluyendo supercomputadores, materiales avanzados y herramientas para maquinaria de precisión. Bajo esta política, el equipo crítico que India requería para sus industrias espacial y nuclear fueron puestas bajo completa prohibición. Aunque el Acuerdo de Wassenaar todavía existe, con países incluso como Rusia e India ahora dentro del ámbito del Acuerdo, no representa una amenaza. La verdadera amenaza proviene de pelearse con el régimen de sanciones estadounidenses y la interpretación de sus leyes suplantando a la legislación internacional, incluyendo las reglas de la OMC.

La ventaja que tuvieron antes los Estados Unidos y sus aliados militares dentro de la Organización del Tratado para el Atlántico Norte (la Organización del Tratado del Sureste Asiático, y la Organización del Tratado Central) fue que EE. UU. y sus aliados europeos eran los mayores fabricantes del mundo. Estados Unidos también controló los hidrocarburos de Asia occidental (petróleo y gas), un recurso vital para todas las actividades económicas. La actual guerra del chip contra China está siendo librada en un momento en el que China se ha convertido en el mayor centro manufacturero del mundo y el mayor socio comercial del 70% de los países del mundo. Con la Organización de Países Exportadores de Petróleo desobedeciendo los dictámenes de los Estados Unidos, Washington ha perdido el control del mercado energético global.

Así que, ¿por qué los Estados Unidos comenzó esta guerra del chip contra China en un momento en que sus posibilidades de ganar son limitadas? En el mejor de los casos, puede aplazar el ascenso de China como potencia militar de primer orden y la mayor economía del mundo. Una explicación yace en lo que algunos historiadores militares llaman “la trampa de Tucídides”: cuando un poder emergente rivaliza con un poder militar dominante, la mayoría de este tipo de casos conducen a la guerra. Según el historiador ateniense Tucídides, el ascenso de Atenas llegó a que Esparta, para el momento el poder militar dominante, fuera a la guerra con ella, en el proceso destruyendo a ambas ciudades-estados; por lo tanto, la trampa. Mientras tales alegatos han sido cuestionados por otros historiadores, cuando un poder militar dominante enfrenta a otro en ascenso, sí aumenta la posibilidad de una guerra bien sea física o económica. ¡Si la trampa de Tucídides entre China y Estados Unidos se restringe a una guerra económica – la guerra del chip – deberíamos considerarnos afortunados!

Con la nueva serie de sanciones estadounidenses, un tema queda establecido: se acabó el mundo del libre comercio neoliberal. Mientras más rápido otros países lo entiendan, mejor será para su pueblo. Y la autosuficiencia no significa simplemente la falsa autosuficiencia de apoyar la manufactura local, sino más bien los medios para desarrollar la tecnología y el conocimiento para sostenerlo y hacerlo crecer.

Este artículo ha sido producido en colaboración con Newsclick y Globetrotter. Prabir Purkayastha es el editor fundador de Newsclick.in, una plataforma de medios digitales. Es un activista de la ciencia y del movimiento del software libre.

Pentagon moves to consolidate control and command of Ukraine war

The United States military is moving quickly to centralize its control over the Ukraine proxy war against the Russian Federation. The Pentagon is establishing a new, high-level command called the Security Assistance Group-Ukraine to be based in Germany. The command, with around 300 personnel, will “oversee how the United States and its allies train and equip the Ukrainian military” according to the New York Times.

The announcement from the Defense Department also included another $400 million in heavy weapons for Ukraine, including 45 heavy tanks, 1,100 drones, and boats. The stated goal is “to ensure we are postured to continue supporting Ukraine over the long term” said Pentagon press aide Sabrina Singh.

The true nature of the Ukraine proxy war was revealed months ago by U.S. Secretary of Defense Lloyd Austin when he admitted the U.S. aim is to “weaken Russia.” In June almost 5,000 U.S. troops from the 101st Airborne set up camp on the Romanian side of the Ukraine border where they have been carrying out war games.

It has been revealed that U.S. troops are being stationed inside Ukraine to reportedly help keep track of the arrival and deployment of billions of dollars worth of military equipment.

It is also known that the Pentagon and the North Atlantic Treaty Organization have personnel situated with the command and supply departments of the Ukrainian military. They are supplying military intelligence and advising on military tactics.

Heavy fighting in the northeast theater has continued. The rapid advance of Ukrainian forces in the Kharkiv area ended after the withdrawal of Russian Federation forces to more defensible lines. Russian troops have counter-attacked in several areas making some gains.

Fighting may intensify greatly in the southern front around the Russian-held city of Kherson. Ukraine has made the taking of Kherson a major military and political goal and both sides seem to be preparing for a major battle. Despite most western media hype about the Ukraine military, Aljazeera gave a more balanced assessment. Quoting a Ukrainian army commander on the ground, the news agency reported that the Ukrainian “counteroffensive had slowed in recent days, partly because Russian troops were heavily dug into fortified positions….we are lacking in equipment to move forward….The Russian army should not be underestimated.”

An aide to Ukraine President Zelensky estimated that Russia has positioned 30 battalions around Kherson, each consisting of 800 soldiers.

The Russians have an overwhelming superiority in air, missile and artillery support for their troops, who are heavily dug into defensive positions in three layers around Kherson. A large percentage of Kherson’s civilians have been evacuated to the east bank of the Dnieper River and there are reports of Russian troops setting up defenses inside buildings throughout the city, should the Ukrainians break through the outer defense lines.

Running short of equipment and trained military personnel, Ukraine may be gambling everything on a victory in Kherson. But even should that happen, it isn’t clear that Ukraine could follow up a costly battle having depleted much of its military strength. In the rear areas, Ukraine’s entire electric grid is being destroyed day by day by Russian drones and cruise missiles. Recently an official of the Kyiv municipal government admitted that 450,000 people in the capital city were without power.

The National Security and Defense Council of Ukraine passed a bill banning any negotiations with Russia as long as President Putin remained in power. Zelensky signed the bill into law on October 4. He has ruled out any talks until Ukraine drives Russia out of the 20% of the country it occupies and has annexed into the Russian Federation – goals that are unlikely to transpire no matter how much money, weaponry and intelligence the U.S. and NATO supply.

Zelensky knows that his position is untenable. That is why, in a speech on October 6, he called “upon NATO to consider ‘preemptive strikes’ against Russia, rather than ‘waiting for the nuclear strikes first.’” Russia’s spokesperson Dmitry Peskov denounced the statement “essentially a call for the start of a world war.” Zelensky’s own press secretary backtracked, saying that the call was for NATO to strike the Russians with conventional weapons. Either way, it exposed the complete dependence of the Ukrainian puppet regime on the U.S. and NATO.

Source: Fighting Words

Japan’s discomfort in the New Cold War

In early December 2021, Japan’s Self-Defense Force joined the U.S. armed forces for Resolute Dragon 2021, which the U.S. Marines called the “largest bilateral training exercise of the year.” Major General Jay Bargeron of the U.S. 3rd Marine Division said at the start of the exercise that the United States is “ready to fight and win if called upon.” Resolute Dragon 2022 followed the resumption in September of trilateral military drills by Japan, South Korea, and the United States off the Korean peninsula; these drills had been suspended as the former South Korean government attempted a policy of rapprochement with North Korea.

These military maneuvers take place in the context of heightened tension between the United States and China, with the most recent U.S. National Security Strategy identifying China as the “only competitor” of the United States in the world and therefore in need of being constrained by the United States and its allies (which, in the region, are Japan and South Korea). This U.S. posture comes despite repeated denials by China—including by Foreign Ministry spokesperson Zhao Lijian on November 1, 2022—that it will “never seek hegemony or engage in expansionism.” These military exercises, therefore, place Japan center-stage in the New Cold War being prosecuted by the United States against China.

Article 9

The Constitution of Japan (1947) forbids the country from building up an aggressive military force. Two years after Article 9 was inserted into the Constitution at the urging of the U.S. Occupation, the Chinese Revolution succeeded and the United States began to reassess the disarmament of Japan. Discussions about the revocation of Article 9 began at the start of the Korean War in 1950, with the U.S. government putting pressure on Japanese Prime Minister Shigeru Yoshida to build up the army and militarize the National Police Reserve; in fact, the Ashida Amendment to Article 9 weakened Japan’s commitment to demilitarization and left open the door to full-scale rearmament.

Public opinion in Japan is against the formal removal of Article 9. Nonetheless, Japan has continued to build up its military capacity. In the 2021 budget, Japan added $7 billion (7.3 percent) to spend $54.1 billion on its military, “the highest annual increase since 1972,” notes the Stockholm International Peace Research Institute. In September 2022, Japan’s Defense Minister Yasukazu Hamada said that his country would “radically strengthen the defense capabilities we need….To protect Japan, it’s important for us to have not only hardware such as aircrafts and ships, but also enough ammunition for them.” Japan has indicated that it would increase its military budget by 11 percent a year from now till 2024.

In December, Japan will release a new National Security Strategy, the first since 2014. Prime Minister Fumio Kishida told the Financial Times, “We will be fully prepared to respond to any possible scenario in east Asia to protect the lives and livelihoods of our people.” It appears that Japan is rushing into a conflict with China, its largest trading partner.

This article was produced by Globetrotter. Vijay Prashad is an Indian historian, editor, and journalist. He is a writing fellow and chief correspondent at Globetrotter. He is an editor of LeftWord Books and the director of Tricontinental: Institute for Social Research. He is a senior non-resident fellow at Chongyang Institute for Financial Studies, Renmin University of China. He has written more than 20 books, including The Darker Nations and The Poorer Nations. His latest books are Struggle Makes Us Human: Learning from Movements for Socialism and (with Noam Chomsky) The Withdrawal: Iraq, Libya, Afghanistan, and the Fragility of U.S. Power.

Why Marx was right about capitalism needing to have periodic crises

The National Business Review reported a comment by New Zealand’s then National Party government Minister of Finance, Bill English, on Aug. 15, 2014, that he had occasionally pointed out in speeches to business audiences that New Zealand has had post-World War II recessions roughly every ten years: in 1957-58; 1967-68; the mid-1970s; the mid-1980s; 1997-98 and 2007-8. He would observe laconically: “You’d think we would see them coming.”

But, of course, bourgeois economists, commentators, and journalists don’t generally see them coming. One problem, however, is that sometimes the Marxist critics of capitalism see them coming a little too often.

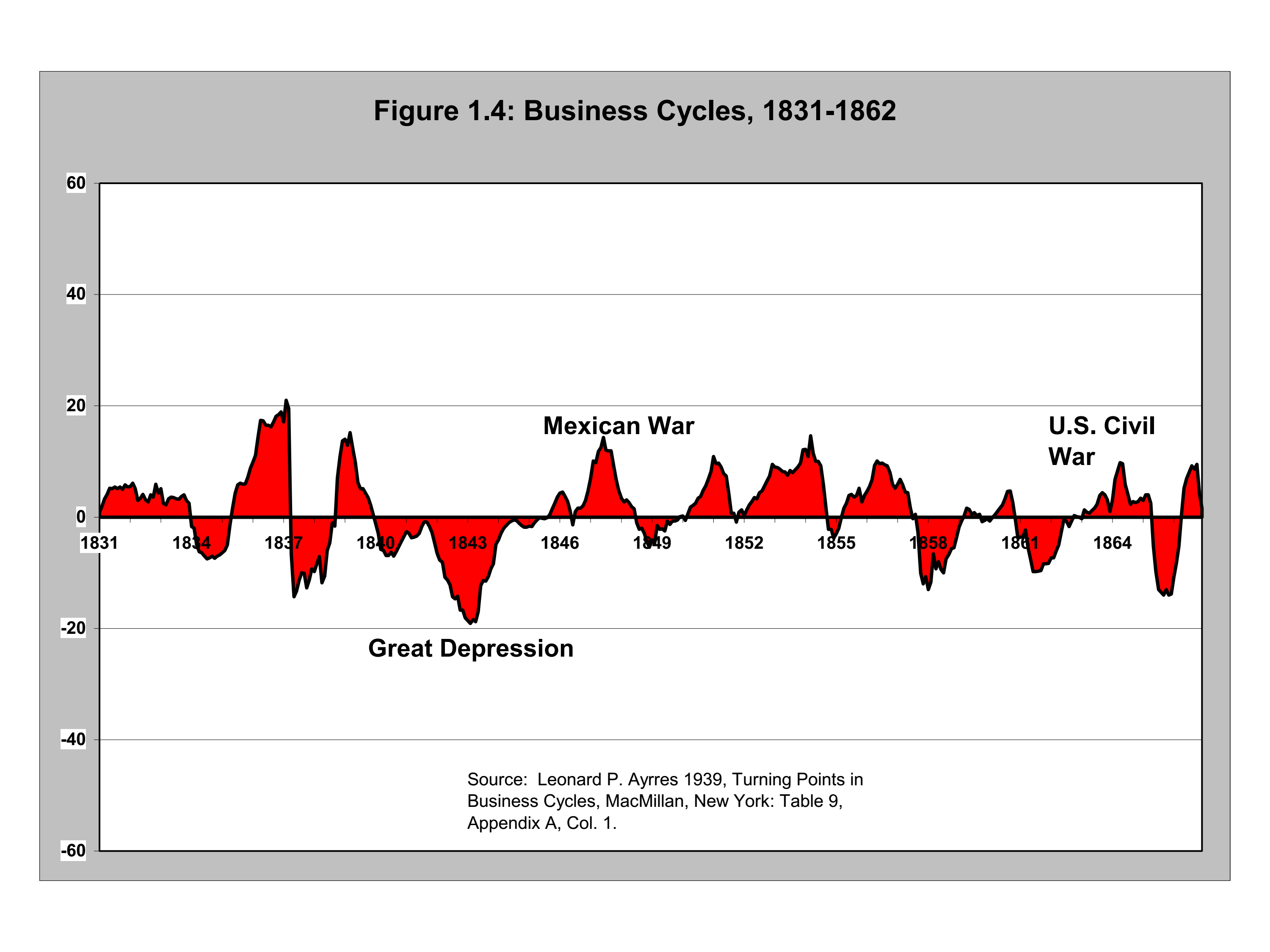

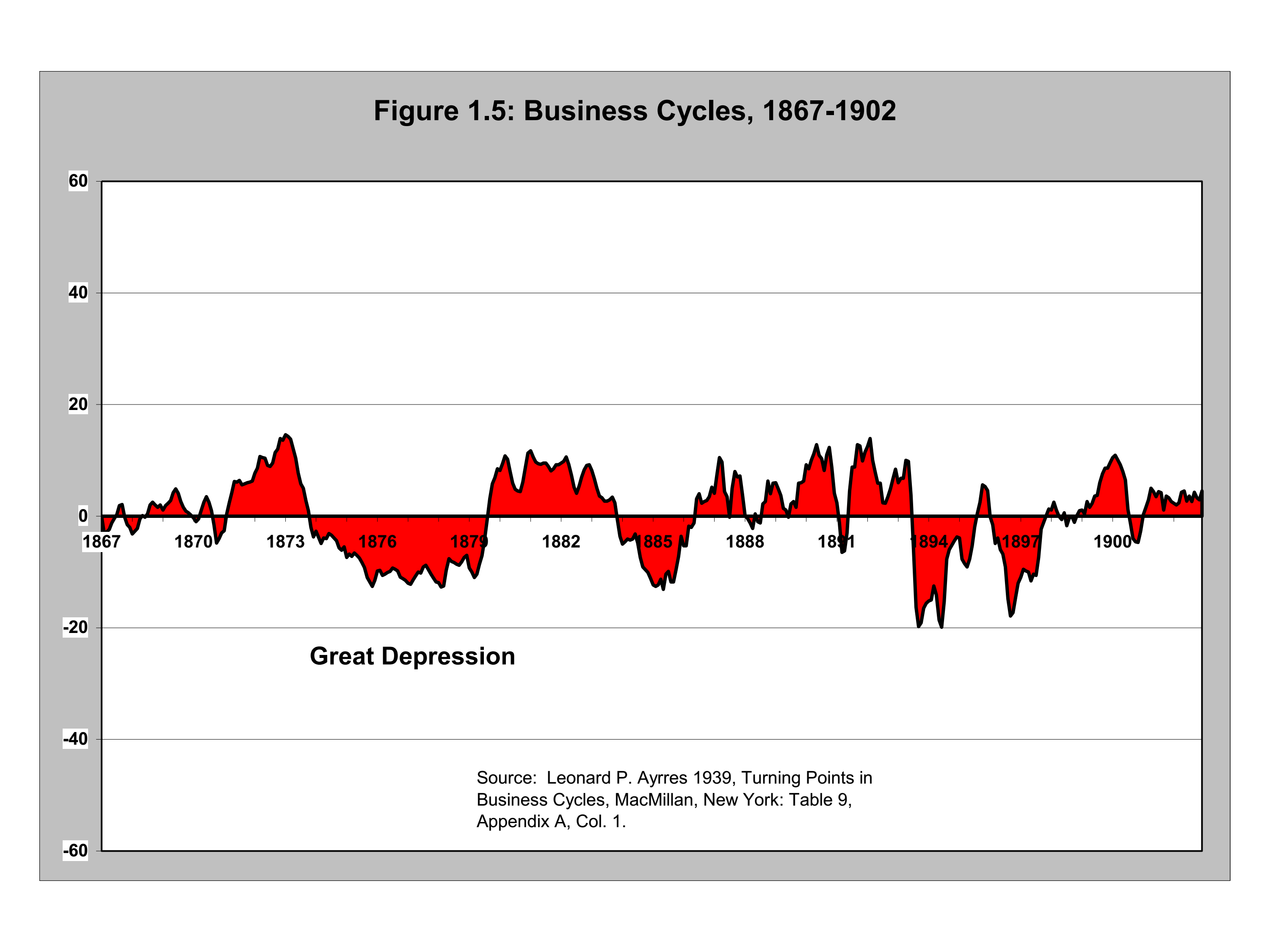

But it is a simple fact of life that capitalism has had economic crises on a periodic basis, at least since 1825. Every 10 years or so, capitalism goes through a cycle of boom and bust. The following charts for the U.S. economy illustrate this reality. They were taken from an important paper by U.S. Marxist economist Anwar Shaikh entitled: “Profitability, Long Waves and the Recurrence of General Crises.”

Capitalism also goes through historical periods where the industrial cycles of boom and bust are more pronounced one way or another. That is, capitalism goes through periods of several decades, such as the post-World War II “long boom” involving multiple cycles where the upturns are relatively stronger than the downturns.

Similarly, there are other periods, such as the decades following the crisis of 1873, where the upward phases of the cycle are relatively weak and the downward phases more pronounced.

Understanding these cyclical fluctuations is also closely connected to another element of Marxist theory that is important to explain what is happening — historical materialism — which is simply a way of viewing and understanding history.

Ever since we humans began generating a consistent surplus, societies have been divided into classes where each class is defined by its relationship to the means and mode of production. The legal, political, social and cultural elements of society arise from this economic foundation.

The relations and modes of production, which determine how the economic system is produced and reproduced, have gone through various stages as technology and the forces of production have advanced. The main stages have been slavery, feudalism, capitalism and the beginning efforts to construct socialism.

Economic systems do not pass away until they have exhausted their progressive functions in terms of increasing society’s productive capacity, which in turn enables population growth and cultural development. When the growth of the productive forces reaches a certain limit within the framework of the existing society, the question is posed: Can the fetters of the existing social relations be thrown off and a new society established?

Marx’s answers

Karl Marx devoted his life to answering this question in relation to capitalism. This was the question from his point of view. Decades of research, decades of writing, decades of reflection — in between throwing himself into labor struggles and the odd revolution when they were happening. But he always returned to this basic task.

The key questions were understanding why capitalism operates the way it does and whether capitalism is a historically limited system — whether it will reach a limit and need to be superseded. Marx’s answers are to be found in his writings, especially his great work known as Capital.

Our inability, so far, to supersede capitalism on a world scale means that periodic crises return, again and again, each one causing great hardship while giving a powerful impetus to the centralization of capital and the growth of monopoly domination.

The system’s dependence on relentless expansion over time and its inherent drive to maximize profit rather than meet human needs mean that we now face the incompatibility of this system with our coexistence with Mother Earth.

That has become an element of crisis theory in the broader sense — demonstrating the increasing incompatibility between a livable environment and the way the system is organized through private property and ownership.

The crises, therefore, tend to get bigger, more prolonged, and more socially destabilizing. We have entered a new period like that with the 2007-8 world recession, the weak recovery following, and now the post-COVID boom and bust in rapid succession.

But there is no final crisis in this system — other than a descent into nuclear war or barbarism arising from the sort of ecological winter or runaway ecological collapse that capitalism appears to be preparing for us. Short of such a disastrous outcome, the system will continue to carry on with its booms and busts until it is overthrown and replaced.

That can only be carried out by a conscious social and political force, by a class that is not bound to the system by material interest. That is why the working class is the only class that can overthrow this system. It is the only class not bound by property and profit to its perpetuation. It is the only class with the numbers and social power, if organized, if conscious enough, to effect this outcome and bring about real majority rule.

Marx’s challenge

The problem faced by Marx was that the challenge he took on in his writing of Capital was so daunting that all we got during his lifetime was the first part of a planned six-part work.

Marx published volume 1, part of his planned first volume in several editions. Friedrich Engels, using Marx’s notebooks, produced what we know of as volumes 2 and 3 after Marx’s death. Then there was the Theories of Surplus Value — a part of a rough draft of a history of economic thought. All of that was originally going to be the first volume of the planned six-part project.

There were to be additional volumes on wage labor, the state, and competition. The entire work was to culminate in the volume on the world market. It was there logically that crises were to be dealt with in a systematic way. Marx does not deal with crises except in scattered references, mostly in volume 3 of Capital and in his correspondence.

Marx’s method was to begin at the most abstract level before moving progressively to the more concrete. In Capital, he begins with the abstract categories of the commodity and value and moves through to the formation of prices and the role of money and the market.

He goes on to explain the origin of profit in surplus value and ties this all in with the origin of capitalism in what he called “primitive accumulation.” Systematic treatment of things like exchange rates, world trade, and so on was to come later.

There was an added problem with what we know as volume 2, published after Marx’s death. Volume 2 is actually more a volume about how capitalism works rather than how it doesn’t. Marx explains how capitalism must be a system of expanded reproduction, and he presents formulas to prove that is how it must exist and, in a sense, how it can exist.

There was a certain consternation and debate inside the socialist movement when volume 2 was published. The revolutionary ideas of Marx and Engels were already under attack within German Social Democracy, the German workers’ party at the time, which followers of Marx and Engels led. Volume 2 was used by critics of these revolutionary ideas to “prove” that capitalism worked and could last indefinitely — in support of the views of the reformist wing of German Social Democracy led by Eduard Bernstein.

Because the cause of crises wasn’t fully spelled out in Marx and Engels’ work, revolutionaries like Rosa Luxemburg started to look for explanations for why crises happen that didn’t quite fit in with the logic of what Marx and Engels had written. She looked at the exhaustion of the world market. Others looked at things like the tendency of the rate of profit to fall, which Marx viewed as a long-term historical tendency.

This logic can be deduced from their major economic works and their journalism and correspondence in which they wrote about and analyzed actual crises until Marx’s death in 1883 and Engels’ in 1895.

Capitalism has also changed significantly since Marx and Engels wrote. These changes need to be incorporated into our understanding of crises. The system has evolved from industrial capitalism based on free competition to monopoly capitalism.

We have been through the Great Depression of the 1930s. We have had the experience of the “Keynesian revolution.” We have had the Monetarist counter-revolution inspired by U.S. economist Milton Freidman and the debates in economic theory around that.

We have also had an end of the international gold standard, a very important event. We had the stagflation of the 1970s and the neoliberal turn in the 1980s.

Most recently, we have had the global “Great Recession” of 2007-9, followed by an unprecedentedly weak recovery, anemic at best for most of the world. Monetarism appeared to be abandoned briefly in favor of Keynesianism again to confront the COVID-19 crisis, only to be reimposed to crush the inflation unleashed in its wake.

Today we are facing a renewed global recession that threatens a return of a great depression. This is because the weak recovery after 2008 still required an enormous explosion of debt. The inflationary money printing followed this to cope with the COVID-19 crisis that will require interest rates we haven’t seen in decades to bring under control. That, in turn, will provoke a cascade of debt and broader financial crises across the globe.

Conflicting crisis theories

Marx had identified the essence of the periodic crises of capitalism as crises of overproduction very early on, even in the Communist Manifesto in 1848. This crisis can only happen because production periodically exceeds monetarily effective demand, which is ultimately determined by the existing size and growth rate of the global hoard of the money commodity — gold.

I am emphasizing this because there has been a retreat from this analysis, including among followers of Marx. In fact, the two main schools of Marxist crisis theory today are not schools based on periodic overproduction crises.

One school is based around the primacy of the tendency of the rate of profit to fall (TROPF). Marx introduced this idea in volume 3 of Capital as an important long-term historical tendency in capitalism. Marx also pointed out many counter tendencies, but the tendency is true over long periods. Many Marxist economists use that important theory as the primary explanation for why capitalism has crises.

This school of thought is associated with the U.S. academic Andrew Kliman and British theorists from the Trotskyist tradition, including the British Socialist Workers Party (SWP) leader Alex Callinicos and the prolific blogger Michael Roberts. All three writers deserve to be read, and there is much to learn from their writings.

But the almost monomaniacal attachment to the TROPF to explain crises leads them astray.

Michael Roberts even tries to explain the 10-year cycle under capitalism as a result of the fall in the rate of profit. It is, of course, true that every crisis is associated with a fall in the rate of profit, but that temporary decline is a result of the crisis, not the cause.

Callinicos seems unable to explain the real growth of capitalism since the 1980s. Because the early 1980s crisis must have been the result of the TROPF, and since there has been no counter tendency big enough to overcome the falling rate of profit sufficiently, the crisis must be permanent. However, the world economy has more than doubled in size in that period, and we have seen an explosive growth in capitalist production in China, which he fails to properly account for in his theories.

The other significant school of thought is associated with the U.S. Monthly Review magazine and its editor John Bellamy Foster. Foster is an important writer on economic matters for the magazine and a leading theorist on Marxism’s relevance to understanding today’s ecological challenges. The Monthly Review school is very influenced by Keynesian ideas. John Maynard Keynes was a pro-capitalist economist who became very influential in the wake of the Great Depression of the 1930s.

Traditional bourgeois economic theory denied that capitalism could have crises. Keynes had been schooled in this theory but, when faced with the crisis of the 1930s, was forced to acknowledge the reality staring him in the face. This was that capitalism could have crises; in fact, it seemed to him to have a tendency towards stagnation. But he believed the state could intervene to alleviate crises, if not eliminate them altogether.

So from a Keynesian point of view, you cannot have a crisis of overproduction. Rather, with Keynes, you have a crisis of under-consumption that can be resolved by the state stepping in to purchase goods directly or printing money to give people to spend themselves and/or using government deficit spending to put more money into the economy. Part of the reason Keynes favored ending the gold standard was to allow this to happen more easily.

Overproduction as the underlying cause of crisis, which is based on Marx’s concept of money as the universal equivalent, has been — especially since the end of what remained of the international gold standard in 1971 — all but forgotten, including by most of those claiming to be Marxist.

Capitalism requires a measure of value that is itself a commodity

Classical political economy, represented by Adam Smith and David Ricardo, was the science of capitalism. Marx developed and perfected their labor theory of value. Smith’s “invisible hand” — the unobservable market force that helps the demand and supply of goods in a free market to reach equilibrium automatically — was the law of labor value in operation.

But Marx also explained that what Smith and Ricardo called “labor” was actually “labor power” or the ability to work. But a capitalist won’t employ labor unless the worker can produce more value in a workday than what they are paid. This “surplus value” is the origin of all forms of profit and drives the invisible hand. This made Marx’s ideas a revolutionary advance on classical political economy and forced the capitalists to abandon the science of political economy.

A central part of Marx’s perfected labor theory of value was that it requires — as does commodity production as a system — a measure of value that is itself a commodity.

Ultimately, gold emerged as the main money commodity because it is durable, contains significant value (amount of abstract human labor measured in units of time) in a small quantity, and is easily divisible. However, it can only be a measure of value because it has value as a product of labor itself, measured by its monetary use value in units of weight.

The pro-capitalist alternative to that theory and Keynesian under-consumptionism is dubbed Say’s Law — an economic principle of early “vulgar” economics named after the French businessman and economist Jean-Baptiste Say (1767—1832). Marx dubbed them “vulgar” economists because they had ceased to seek a scientific explanation for what was happening and instead provided simple apologies for capitalism and its laws.

Say stated that production creates its own demand. Commodities are bought with commodities. Money plays no particular role except as an intermediary.

This idea, combined with marginalism — the theory that commodities have exchange value because of their scarcity relative to human needs — tries to banish the labor theory of value by claiming things have value due to their marginal utility and that generalized overproduction of commodities is impossible.

Essentially, this is a subjective rather than objective theory of value. Marginalism, which assumes Say’s Law either explicitly or implicitly, was the end of bourgeois economics as any form of science. All bourgeois economics today is built on these two theories and can’t escape them.

The abolition of the gold standard has created very real problems with the modern U.S. dollar-based international monetary system, with permanent inflation, regular exchange rate crises, and so on. Following the Bretton Woods monetary conference in 1944 up to 1971, when Nixon took the dollar off the gold standard, money in everyday use nearly always had a legally fixed relationship to gold via the U.S. dollar.

You could go to a central bank and demand a certain amount of dollars for your currency, which in turn would represent a specific amount of gold-backed by the bullion hoard in Fort Knox.

Prior to 1933, individuals, as well as countries, could demand gold for their paper U.S. dollars. After 1933, up to 1971, foreign governments and their central banks — but not individuals — could do the same.

But after the gold standard was completely abandoned, there was an assumption on the part of many Marxist economists that maybe Keynes was right on one point. Maybe now you could just create money at will. The state had the power not just to create tokens representing gold but create currency at will with no relationship to gold — now supposedly “just another commodity” like all others with no special role.

That is a big mistake. Ultimately, all non-commodity money — token money and credit money — must have a relationship to a real money commodity like gold. This is true whether a formal gold standard exists or not. This lawful economic relationship still exists and therefore continues to be the underlying cause of crises of overproduction.

When they started to print money at will, in the 1970s, when Nixon said, “We are all Keynesians now,” you ended up with a severe bout of inflation as printed money lost value and its fixed relationship to the money commodity, which remained gold.

The “price” of gold surged — it took more and more tokens to represent the same amount of gold. Monetary tokens were being devalued, and inflation was the inevitable result.

Engels (and Marx) on overproduction crises

The nature of a crisis as an overproduction crisis was spelled out by Engels in 1873.

Engels was a remarkable man. He worked managing his family business in Manchester for some decades, operating as a capitalist in the textile trade. He did that so he could keep his friend and intellectual partner free to work on Capital. He hated what he did.

Engels was a brilliant man, but he knew there was one person — Karl Marx — who alone at that time was both willing and able to carry through the critique of bourgeois political economy. Engels was willing to do whatever was necessary to enable Marx to work. The correspondence of Marx and Engels is extraordinarily rich in political and economic analysis.

Engels begged Marx to get on with the task of writing the book. Marx promised again and again that it was just around the corner. There came a certain point in his life when Engels could give the business up, and there is a wonderful letter where he expressed his joy at being liberated from his role as an industrial capitalist.

Engels did a lot of writing in defense of the joint views of Marx and Engels. One of his major works was a polemical work in 1877 called Anti-Duhring against a then fashionable but now obscure German professor. It became an exposition of the mature views of Marx and Engels on a broad range of political, historical, philosophical and economic ideas.

By this time, all of Marx’s major economic concepts had been developed. He even wrote a chapter of Anti-Duhring himself. For those attached to the TROPF, it is not mentioned once as a cause of crisis. However, they did write an important paragraph summarizing their joint views on the origin of crises under capitalism. It reads:

We have seen that the ever-increasing perfectibility of modern machinery is, by the anarchy of social production, turned into a compulsory law that forces the individual industrial capitalist always to improve his machinery, always to increase its productive force.

The bare possibility of extending the field of production is transformed for him into a similarly compulsory law.

The enormous expansive force of modern industry, compared with which that of gases is mere child’s play, appears to us now as a necessity for expansion, both qualitative and quantitative, that laughs at all resistance.

Such resistance is offered by consumption, by sales, by the markets for the products of modern industry.

But the capacity for extension, extensive and intensive, of the markets, is primarily governed by quite different laws that work much less energetically. [Emphasis added]

The extension of the markets cannot keep pace with the extension of production.

The collision becomes inevitable, and as this cannot produce any real solution so long as it does not break in pieces the capitalist mode of production, the collisions become periodic.

Capitalist production has begotten another “vicious circle.”

The problem is Engels didn’t spell out what these laws are that govern the capacity for growth of the markets and why they work much less energetically.

But he spells out that he sees the cycles of capitalism and the crises they produce as a periodic collision of two counterposed forces—the physical ability of capitalism to use modern science and technology to expand production without limit, and the different, less energetic laws governing the growth of the markets.

Laws governing the growth of markets

The laws that govern the growth of markets are connected to the role of the money commodity as a measure of value and periodic changes in the relative profitability of gold production versus the production of other commodities.

Gold is both the universal equivalent, the measure of value, and a commodity in its own right. Therefore its production remains key to understanding the laws of capitalism that determine value, price and profit.

But if you look at the history of capitalism, there is a peculiarity about gold. Because it is the ultimate measure of value, the production of gold tends to move countercyclically to overall commodity production. So when there is an overall boom in production in society, gold production tends to decline, and during overall depressions in society, gold production tends to increase. This is an important mechanism for regulating capitalism.

As prices in gold terms (in weights of gold) rise during the rising phase of the industrial cycle, gold’s purchasing power falls, gold production becomes relatively less profitable, and capital flows out of that sector, gold production slows, interest rates rise as money becomes tight, and the boom ends in a crash.

When prices in gold terms fall sharply in a crisis, gold’s purchasing power rises, gold production becomes relatively more profitable, and capital flows into the sector, causing gold production to rise, adding to the growing idle money hoard resulting from the crisis itself, pushing down interest rates, and the economy recovers.

The capitalist system seeks to escape the limits of monetarily effective demand by, as Marx explained some 150 years ago, expanding credit. But credit cannot expand forever, even with all the modern-day miracles performed by modern computers. In the end, the debt must be serviced—interest and principal paid—and eventually the game is up. Interest rates rise during the industrial cycle’s boom (overproduction) phase, credit collapses, and another crisis is born.

Critique of Crisis Theory blog

In the last decade, I have been working with a small group of Marxists in North America doing a blog focused on economics that I highly recommend. It is called A Critique of Crisis Theory. What I have been explaining here are essentially their ideas.

The blog’s first 40 or so posts are being turned into the draft of a book we hope to serialize soon. The author of the blog, Sam Williams, and his collaborators have been working on their economic ideas for some decades. The creation of the Internet has allowed these ideas to be shared with a much wider audience than was possible before.

More recently, Williams has been responding to new developments and discussing with others who have engaged or critiqued his ideas. I tried to critique his views on an aspect of economic theory I thought I had some familiarity with — productive and unproductive labor.

Classical economists and Marx recognized that not all labor performed was productive of value and surplus value. We can see this easily when we look at the “labor” of a police officer, priest or soldier versus the labor of a miner or factory worker. I think we can identify who is a productive worker in that picture.

It gets more complicated when we look at the labor of bank workers and retail workers whose labor may or may not be necessary for production to occur. It gets even more complicated when we look at workers in health and education who may be employed in a private business producing a profit for the capitalist. Anyway, that is the area I wanted to discuss.

Sam was patient in his responses and took the time to respond to my first questions in a very pedagogical way.

Then when I wrote back, still disagreeing, he wrote an even longer and more thorough response that included a reference to Albert Einstein, who, he said, proved that matter and energy are different forms of the same thing, just as physical goods and “non-material” services can both be commodities embodying labor value. That sealed the issue for me, and I conceded they had a far better understanding of this issue.

What I found by following the blog was that it appeared to answer many of the questions and doubts I had from my own reading of Marxist economic theory, which has been an interest of mine though I am no “expert,” which I will come back to. From a young age, I had been very interested in Marxist economic theory. Initially, I had been strongly influenced by a prominent Belgian Marxist economist named Ernest Mandel. Much of what he wrote remains useful.

In some things he wrote in the 1970s, Mandel hints at the continuing importance of the role of gold as the money commodity. He played an important role in analyzing the “long waves” of 40 or 50 years duration that appear to be a feature of capitalism, which I believe is correct.

The Critique blog author also believes long waves play an important role and provides an explanation for a long cycle based on long-term swings in gold production, which makes the argument for its importance even more powerful.

Another fine economist, Anwar Shaikh, who knows his Marx and supports an understanding of the history of capitalism involving long waves, has produced a graph that seems to support the Critique of Crisis theory on this point. He follows the long-term movement of wholesale prices in the U.S. and the UK.

He shows in his graph that there is a movement in wholesale prices upwards during a period of the long wave that is dominated by strong upturns in the business cycles and trends downward in prices during a period of the long wave where business cycles are dominated by the downward phase of the cycle. The decline in wholesale prices is associated with a period of stagnation or long depression under capitalism. So we have the 1873-1893 decline, the Great Depression of 1929-1939, the Great Stagflation of 1967-1982, and a similar decline, which he argues indicates a new Great Depression, beginning in 2008, which he describes in a lecture as a “very scary” conclusion for his students at that time.

To produce an accurate version of the graph, he needed to measure the prices in terms of gold because, in the period following the abolition of the gold standard, there has been a permanent inflation in paper money prices that hides the real movement of prices in gold terms. This fits very closely with the Critique of Crisis Theory blog’s view, even though Shaikh is broadly in the school that looks for the cause of crises in the TROPF.

The crisis theory blog brings the very useful empirical work by Shaikh into long waves and crisis theory together in a blog as follows:

As a rule, after several industrial cycles dominated by the boom phases, the general price level rises above the value of commodities. This causes the rate of profit in the gold (money material) producing industries — mining and refining — to become less profitable than most other branches of industrial production. Capital, therefore, begins to flow out of gold production and refining.

As the production of money material declines, the quantity of money grows at an increasingly slow rate relative to real capital — productive and commodity capital. As a result, credit increasingly replaces money, eventually stretching the credit system to its limits.

Money becomes tight, and interest rates rise. This situation, assuming capitalist production is retained, can only be resolved by a crash or a series of crises and associated depressions of greater than average intensity, duration, or both.

One result of a crisis or series of crises of greater than usual violence or duration is a lowering of the general price level — measured in terms of the use value of gold bullion — once again to below the value of commodities. This makes gold production and refining industries more profitable than most other industries.

Capital once again flows into gold mining and refining, causing the production of gold bullion to rise once again. The quantity of money then expands with low interest rates and “easy money.”

As the process of liquidating the previous overproduction goes on, especially of those commodities that serve as means of production, the accumulation of (real) capital stagnates. As a result, for a period of time, money capital is accumulated at a faster rate than real capital.

But once the accumulated overproduction — especially in the form of surplus productive capacity — is liquidated, a new “sudden expansion of the market” occurs, leading to a series of industrial cycles dominated by the boom phases rather than the crisis or depression phases.

This “long cycle” is built into the commodity foundation of capitalist production and is the inevitable result of the commodity form itself once it is fully developed.

But this cycle is also affected by accidental events such as discoveries of rich new gold mines and technological improvements in gold mining or refining that can either weaken or reinforce it depending on circumstances, as well as by such “accidents” as wars and revolutions.

So history is not an automatic repetition of cycles but a complex process involving both chance and necessity.

Williams and his collaborators are quite orthodox in demanding a return to Marx on the nature of capitalist crises as crises of the general overproduction of commodities. At the same time, they incorporate major developments of the capitalist system in the 150 years since Marx and Engels wrote in order to explain what is happening today.

An important contribution

The Critique of Crisis Theory blog is making an important contribution to Marxist economic theory today. The blog is getting thousands of page views monthly and becoming influential in Marxist economic debates. It is getting the recognition and respect it deserves.

The world reality we face today is conforming to the central theses of the blog. The current unfolding crisis and the 2007-9 crisis are both clearly global crises of overproduction. There were simply too many houses, too many cars, and so on. Of course, “too many” from the point of view of being “too many” to be sold for a profit, not in terms of human need.

I think we all should pay respect to the founders of scientific socialism and give this issue of crisis theory the attention and importance it deserves. We cannot leave it to others, to “professionals” or self-selected “experts.”

I am not an “expert” on this stuff. It has been a continuing interest of mine because it is important that we understand it and because it is important we understand what is happening and who we are, what our role is, what we expect will happen to this system, who the agent of social change is going to be, and what the prospects are for making change in the world today. Those are all issues that anyone who wants to find a way out of the permanent crises capitalism seems to have in store for us can begin to address.

Mike Treen is an Advocate for Unite Union in New Zealand. Two decades ago, Unite began a successful campaign to organize workers who had lost union protection in the 1990s in an extreme “neoliberal” attack on workers’ rights. The employment law at that time did not mention unions. Unite now has union-negotiated collective agreements in fast food, cinemas, hotels and call centers. This includes at McDonalds, which hasn’t signed a collective agreement in any other country which has “voluntary” unionism and no legal compulsion to do so. In 2015, Unite Union led a campaign against zero-hour contracts in the fast food industry that led to their legal abolition under a National Party-led government. This party had implemented the 1990s reactionary anti-worker “reforms.” Unite Union is also active in broader social movements around migrant rights, housing and international solidarity movements like the struggle for Palestine. Mike Treen himself went on a boat trip to try and break the siege of Gaza in 2018. (See a 2009 report) or watch this video.)

Throwing door open for oppressed people: Bolshevik Revolution changed the world forever

One-hundred-and-five years ago, on Nov. 7, 1917, workers and peasants overthrew the capitalist government in Russia. The world hasn’t been the same since.

Two million soldiers in the Russian army had died in World War I. Russia was ruled by the cruel Czar Nicholas II.

Like the United States, the Russian Empire was a big prison of oppressed nationalities. Uzbeks, Kazakhs, Poles, Ukrainians, Georgians, Finns, Armenians, and other peoples were denied independence.

Wars of conquest slaughtered Muslims. As with Native nations in the Americas, Siberia’s Indigenous peoples were hunted down and killed.

Russian people were also oppressed. Many had been serfs, a sort of land slavery. But serf families couldn’t be broken up and sold like cattle, as African slaves were in the U.S.

Thirty thousand serfs died building St. Petersburg, the former Russian capital.

Serfdom was abolished in 1861, two years after the raid at Harpers Ferry led by John Brown. The outbreak of the U.S. Civil War may have influenced the czar to get rid of serfdom before the serfs got rid of him.

Lenin and the Bolsheviks

By 1914, serfdom was gone, but 30,000 big landlords still ruled the countryside, where five out of six people lived. The vast majority of peasants couldn’t read or write. Women had no rights.

Foreign capital poured into Russia, grabbing huge profits from long workdays in the factories. Striking workers were shot down.

Oppression breeds revolution. V.I. Lenin was the greatest leader of Russia’s revolution. He organized a communist party known as the Bolsheviks.

Lenin was 17 when his older brother Alexander was hanged for trying to assassinate the czar. When the Black revolutionary Jonathan Jackson was 17, he was killed trying to free his older brother George Jackson and other political prisoners.

Lenin studied the teachings of Karl Marx. Lenin taught that workers had to be saturated with Marx’s revolutionary knowledge and determination to win.

Soviets vs. pogroms

The first Russian Revolution broke out in 1905. Workers went on strike, shutting down factories and railroads. Peasants burned the gentry’s mansions. Czarism was on the ropes.

Workers formed councils called soviets. Today, we need peoples power assemblies to fight cutbacks, racism, and war.

European banks poured in loans to save czarist tyranny. In 1960, David Rockefeller’s Chase Manhattan bank — now the JPMorgan Chase & Co. bank — saved South Africa’s tottering apartheid regime with loans following the Sharpeville massacre.

The 1905 Revolution was also defeated because the czar was able to pit peasant soldiers against workers and even other peasants. Billionaires divide poor and working people in the U.S. today with racism and anti-immigrant bigotry.

Mass lynchings called pogroms led by czarist flunkies killed Jewish people. Hundreds of African Americans were massacred in pogroms in East St. Louis, Ill., in 1917 and in Tulsa, Okla., in 1921.

The Bolsheviks fought pogroms with guns in hand. Lenin waged war on racism. He enriched Marxism by teaching that workers in the big capitalist countries had to support revolts in the colonies.

“What emotion, enthusiasm, clear-sightedness and confidence it instilled into me!” was how Vietnamese leader Ho Chi Minh described Lenin’s “Theses on the National and Colonial Questions.”

The Black poet Claude McKay, who wrote “If We Must Die,” spoke in Red Moscow.

Peace, land and bread

Sick of war and hunger, women textile workers in Petersburg went on strike on March 8, 1917 — International Women’s Day. The holiday commemorates a strike of women garment workers in New York City.

Five days later, czarism was overthrown. Workers, peasants and soldiers made the revolution, but capitalists seized the reins.

For the next eight months, Lenin’s Bolsheviks won millions of poor people to socialist revolution by demanding bread, peace and land. Despite Lenin being forced underground, Bolsheviks won majorities in the soviets that sprung up everywhere.

These soviets overthrew capitalist leader Alexander Kerensky on Nov. 7. It’s called the Great October Socialist Revolution because under the old Russian calendar it occurred in October. It’s also called the October Revolution because many peoples, not just Russians, rose up to break their chains.

Peasants threw out the landlords. Bolsheviks exposed secret treaties that divided up colonies among the imperialist countries. This revolutionary energy helped overthrow Germany’s kaiser and end World War I.

Capitalist governments, including the U.S., waged war against the soviets on a dozen fronts. But the Red Army, led by Leon Trotsky, was victorious.

The 73-year-long war

The Soviet Union remained the target of world capitalism. Hitler came to power over the bones of the German working class.

Following Lenin’s death, this political isolation led to backward steps, including abolishing abortion rights. Soviet leader Joseph Stalin framed Bolshevik opponents while increasing inequality.

At the same time, the Soviet Union launched the first and biggest affirmative action program in history. Every person had the right to an education in their own language. The Soviet five-year plans created the world’s second-biggest economy. Everyone had a job.

Under Stalin’s leadership, the Soviet Union defeated Hitler. An estimated 27 million Soviet people died in World War II. The Red Army liberated Auschwitz, which the U.S. refused to bomb.

The Bolsheviks inspired the Chinese Revolution. The Soviet Union armed Korea and Vietnam against the U.S. war machine. Cuba was aided.

In 1988, it was Soviet weapons that allowed Angolan, Namibian, African National Congress and Cuban soldiers to defeat South Africa’s apartheid army at Cuito Cuanavale. Two years later, Nelson Mandela walked out of jail.

The Pentagon spent $5.5 trillion on nuclear weapons aimed at the Soviet Union. This unrelenting pressure finally led to the Soviet Union being overthrown in 1991.

Despite this tremendous defeat, the October Revolution will live forever.

Movimientos de base en Puerto Rico

Aunque en Puerto Rico la Junta de Control Fiscal impuesta por Estados Unidos y el gobierno proestadista siguen como tren desbocado la avanzada neoliberal de privatizaciones y políticas para vender el país, hay sin embargo, un conjunto de organizaciones a nivel comunitario que luchan haciéndole frente a estas políticas.

Y hace unos días éstos esfuerzos a nivel de pueblo coincidieron en dos amplias reuniones en Utuado y Adjuntas, en el área montañosa del país.

Una fue el Primer Encuentro Nacional de Agroecología de Boriken que se hizo en el recinto de Utuado de la Universidad de PR. Allí se reunieron decenas de pequeños agricultores y agricultoras para coordinar esfuerzos a nivel del archipiélago y así fortalecer su trabajo de producción, ya que no existe ningún incentivo gubernamental suficiente para que nuestro país sea autosustentable en este renglón tan imprescindible. De hecho, la política gubernamental es incentivar grandes corporaciones extranjeras como Monsanto. Esta política nefasta queda reflejada en que se importa ¡un 85%! de los alimentos que consumimos.

A unos minutos de Utuado, en Adjuntas, también se reunían con urgencia decenas de organizaciones de base en lo que llamaron un Junte Comunitario de territorios insumisos. Allí también la meta era la coordinación para una lucha de rescate del país.

Estas organizaciones que día a día están dando la batalla por la defensa del medioambiente, rescatando terrenos y edificios, haciendo asambleas en plazas públicas para la educación popular, preservando nuestra cultura, luchando en contra del desplazamiento de comunidades pobres y muchas otras acciones que benefician a sus comunidades, tienen un denominador común. Y es el afán de los capitalistas imperialistas para convertir a Puerto Rico, en un centro financiero para el beneficio de millonarios extranjeros.

Pero gracias al trabajo de todas estas organizaciones de autogestión junto a las demás agrupaciones y partidos políticos de izquierda, la tarea de vaciar a PR para que sea un PR sin puertorriqueños va a ser muy difícil. Y como dice la consigna, “ni la Junta, ni bonistas, Puerto Rico es nuestro, y punto!

Desde PR para Radio Clarin de Colombia, les habló Berta Joubert-Ceci

1